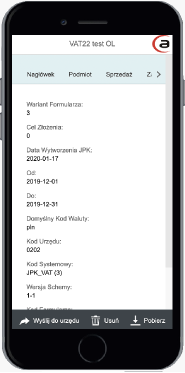

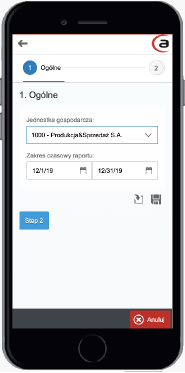

Standard Audit File (JPK) is a comprehensive report that companies are required to provide to the control authorities. It’s an XML file with an established logical structure covering most of the financial and accounting processes in companies.

The obligation applies to the monthly dispatch of VAT-related information and reporting of other structures only upon request of the tax authorities in the case of standard control.

Starting from October 2020, dispatch of data in V_7 format (VDEK) will be mandatory for VAT purposes. This structure includes data from VAT JPK and VAT-7 declarations.

As of 1 January 2025, reporting obligations for income tax information and fixed assets will change.

Taxpayers covered by the new obligation to send their accounts to the US in electronic form via JPK CIT should be aware of these changes and start preparing for the introduction of electronic bookkeeping in accordance with the new guidelines of the Ministry of Finance.