As of January 1, 2022, taxpayers can voluntarily use the National e-Invoice System (KSeF – Krajowy System e-Faktur), which greatly facilitates the settlement of business-to-business trade. On January 19, 2024, the Minister of Finance postponed the deadline for the mandatory implementation of KSeF, which assumed the use of structured e-invoice in July 2024. Although at this point, we do not know the new binding date, certainly KSeF will be implemented in Poland, as EU regulations require this.

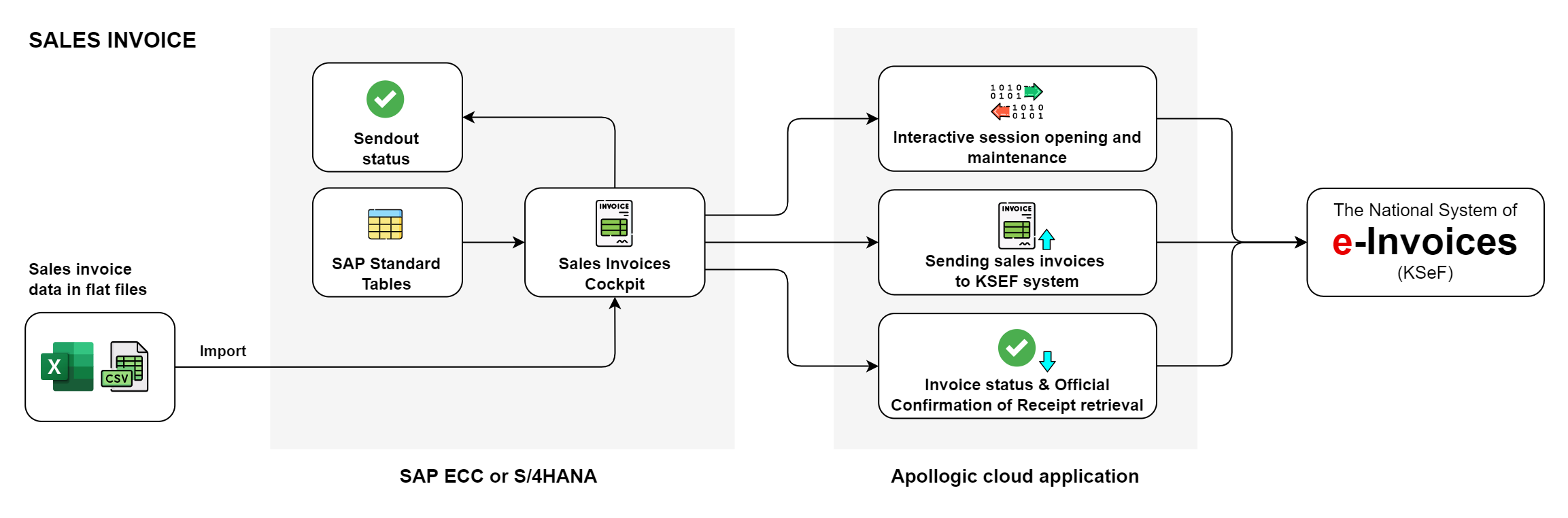

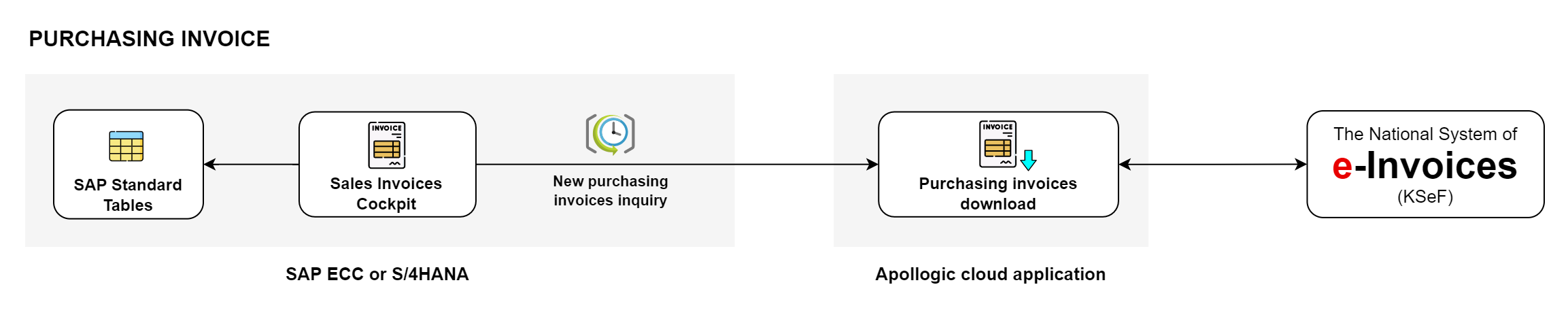

To support organizations and automate the provision and receipt of structured invoices, Apollogic experts have prepared a solution that integrates KSeF with SAP.