Generating SAF is an obligation for foreign companies

According to information published by the Ministry of Finance, the obligation to deliver SAF files will be valid not only for Polish companies. It also covers entities which do not have a fixed place of business in Poland, but pay VAT in our country.

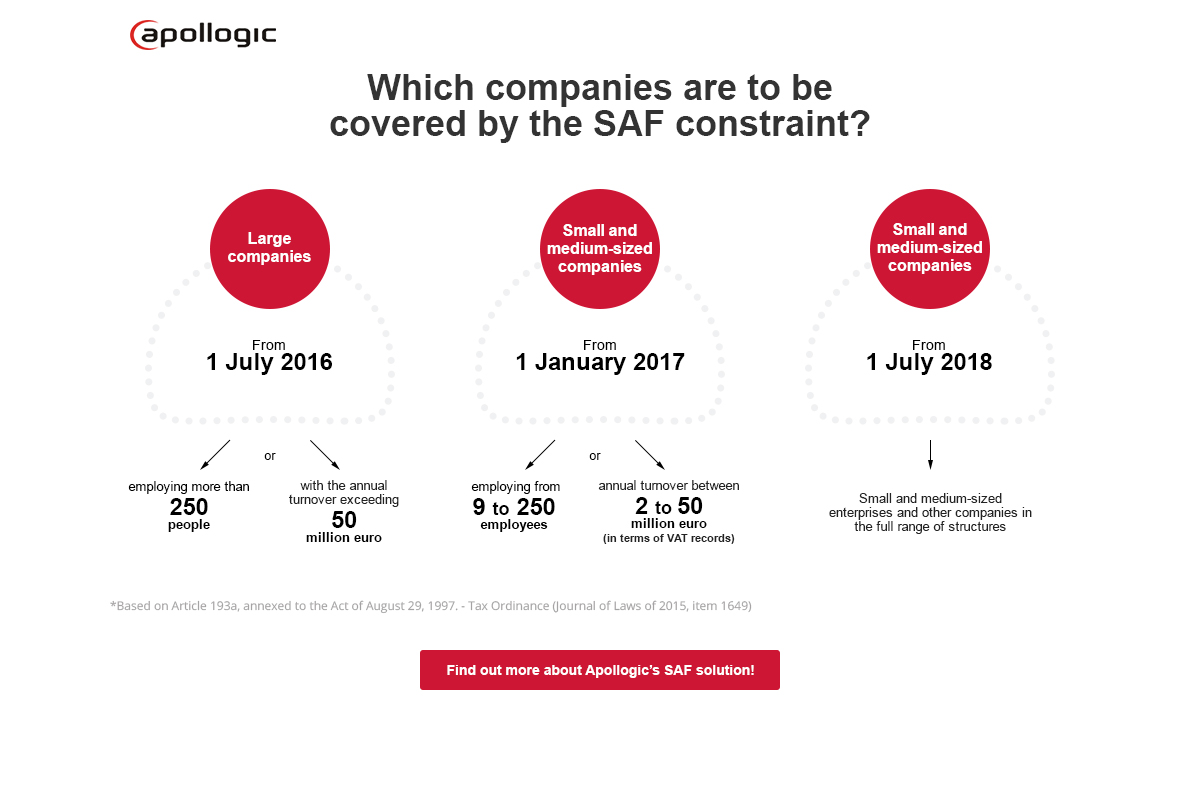

This applies to large companies, employing more than 250 people, with net annual turnover exceeding 50 million euro. The interpretation of this regulation, published by the Ministry of Finance also envisages the obligation to account for the activities of companies operating in Poland, which do not include accounting, financial, and warehouse data in a global context. However, it includes the size of a company on a global scale.

The following visualization summarizes the categories of businesses covered by the obligation of generating SAF:

- On 02/06/2016

0 Comments